- Contractor

- Umbrella

Contractor:

Umbrella

If you’re looking for a compliant Umbrella company with pension planning options, award-winning benefits and a variety of packages to choose from, then Giant has the solution for you.

Award winning Giant Umbrella

Our Umbrella service is designed to be simple, paperless and hassle-free. We ensure that you receive the right level of support when on assignment, take care of all PAYE tax deductions, give you pension planning options, and provide you with a mobile 1st portal so you can easily access your data.

Quick response times and a customer service team that are knowledgeable and happy to help is how a lot of our contractors describe working with Giant. We also process payments via faster pay which means same day payments are available immediately.

All you need to do is complete your timesheets and we will do the rest. We partner with many agencies in such a way that you don’t even have to submit your timesheets to us!

Our umbrella service is designed to be simple, paperless and hassle-free. We ensure that you receive the right level of support when on assignment, take care of all PAYE tax deductions, give you pension planning options, and provide you with a mobile 1st portal so you can easily access your data.

Quick response times and a customer service team that are knowledgeable and happy to help is how a lot of our contractors describe working with giant. We also process payments via faster pay which means same day payments are available immediately.

All you need to do is complete your timesheets and we will do the rest. We partner with many agencies in such a way that you don’t even have to submit your timesheets to us!

Assumptions:

It is important to note that your agency will quote you the limited company rate, which can often be confusing because this is Giant’s income and not yours. To get your actual taxable gross pay rate, there are a number of deductions that need to be made which include; Employer’s National Insurance, Apprenticeship Levy, Employer’s pension (where applicable) and our weekly net margin. The remaining balance is your taxable gross pay, which is subject to PAYE tax and Employee’s National Insurance. The government recognises this confusion and as part of the Good Work Plan, introduced legislation so that agencies must provide all workers with a Key Facts Document detailing these deductions so you can better understand your actual taxable gross pay rate. If you have not received a Key Facts Document from your agency, please request one from them before you start your assignment.

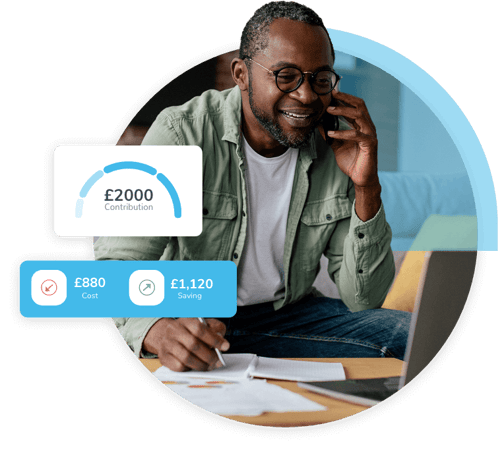

- Salary sacrifice pension contributions save employer’s national insurance and employee tax at your highest rates. For every £2,000 contributed, it costs £1,120 or £880 for a basic rate and higher rate tax payer, respectively

- The illustration is based on being opted out of the workplace pension; if you meet the qualifying criteria, you will be auto-enrolled after 90 days and will have the option to opt out after this

- If your hirer has no supervision, direction or control over you, you can also claim home to site travel expenses subject to completing a questionnaire that validates this

- Your gross pay is made up of Basis Pay, and a Conditional Payment

- This illustration is based on holiday being rolled up and pre-paid

- Takes into account a personal allowance based on 1257L tax code, taxes at basic rate, higher rate, additional rate and a tapered allowance for income above 100K per year

- Joining the optional umbrella plus package which includes additional benefits increases the weekly margin by £3.75. This will reduce your net income by £2.31 or £1.91 for a basic and higher rate tax payer respectively

- This illustration is based on operating through our UK umbrella. For non-UK illustrations, please contact our team.

Packages to suit

everyone

Standard from

£

/wk

Top features

Same day faster payments & advances

Payment text alerts

Daily payrolls

Support team (8am-8pm weekdays)

24/7 access to a mobile 1st portal

Fast/human response live chat

Auto enrolment pension

Statutory payments

(holiday, sick, maternity & paternity)

References

£30 million insurance package

Giant advantage

(discounts and rewards platform)

Employee assistance programme

GP helpline - 24/7, 365 days per year

Private prescription service

Payment to a private pension provider

Quarterly 1-2-1 review

Medical diagnostic scans

Online health assessment

Dental & dental trauma

NHS prescription charges/flu vaccinations

Allergy testing

Optical

Plus from

£

/wk

Top features

Same day faster payments & advances

Payment text alerts

Daily payrolls

Support team (8am-8pm weekdays)

24/7 access to a mobile 1st portal

Fast/human response live chat

Auto enrolment pension

Statutory payments

(holiday, sick, maternity & paternity)

References

£30 million insurance package

Giant advantage

(discounts and rewards platform)

Employee assistance programme

GP helpline - 24/7, 365 days per year

Private prescription service

Payment to a private pension provider

Quarterly 1-2-1 review

Medical diagnostic scans

Online health assessment

Dental & dental trauma

NHS prescription charges/flu vaccinations

Allergy testing

Optical

Premium from

£

/wk

Top features

Same day faster payments & advances

Payment text alerts

Daily payrolls

Support team (8am-8pm weekdays)

24/7 access to a mobile 1st portal

Fast/human response live chat

Auto enrolment pension

Statutory payments

(holiday, sick, maternity & paternity)

References

£30 million insurance package

Giant advantage

(discounts and rewards platform)

Employee assistance programme

GP helpline - 24/7, 365 days per year

Private prescription service

Payment to a private pension provider

Quarterly 1-2-1 review

Medical diagnostic scans

Online health assessment

Dental & dental trauma

NHS prescription charges/flu vaccinations

Allergy testing

Optical

Pension

planning options

We know that for some of you pension planning is important, so we have introduced umbrella premium where you can contribute into your private pension. You can gain significant tax savings by contributing into a private pension – for example as a higher rate taxpayer, for every £2,000 contribution you can save £1,120 and it only costs you £880!

These large savings are possible because, not only do you save on your personal tax and employee’s NI, but the contributions also reduce the employer’s NI and apprenticeship levy we pay.

At Giant we always pass these employer’s NI and apprenticeship levy savings on to you, but be aware that there are other umbrella companies that do not do this.

How Giant

umbrella works

Getting started

You become an employee of Giant and have all the benefits and rights of an employee such as holiday, sick, maternity and paternity pay as well as access to a number of pension planning options.

Your agency will quote you the umbrella limited company rate, which can often be confusing because this is Giant’s income and not yours. To get your actual taxable gross pay rate, there are a number of deductions that need to be made which include; Employer’s National Insurance, Apprenticeship Levy, Employer’s pension (where applicable) and our weekly net margin. The remaining balance is your gross pay, which is subject to PAYE tax and Employee’s National Insurance - the government recognises this confusion and as part of the Good Work Plan, has introduced legislation so that agencies must provide all workers with a Key Facts Document detailing these deductions so you can better understand your actual taxable gross pay rate. If you have not received a Key Facts Document from your agency, please request one from them before you start your assignment.

Expense eligibility

Dependent on your eligibility you may be able to claim expenses that can increase your take home pay. If you’re outside of something called supervision, direction and control i.e. you control how you work, then this could increase your take home pay. You can complete our questionnaire to check eligibility to claim expenses after completing our online joining process.

Holiday pay

With Giant Umbrella you decide whether you have your holiday pay paid in every payroll on a rolled-up pre-paid basis, which means when you take time off you will not receive any additional payment; or alternatively, it can be accrued and set aside in every payroll and paid to you when you take time off.

Almost all workers choose to have their holiday pay rolled-up and paid as they work; however, the decision will always be yours and you will be asked to select your preferred option during the onboarding process. Whichever option you decide we will send you regular emails throughout the year to remind you to take your holiday.

Join online today.

We appreciate you are busy, so we’ve made it even easier to join Giant.

With us, you can join Giant Umbrella online meaning you don’t have to speak to anyone at all if you don’t want to! Oh and by the way, our margin starts from only £22 per week (£10.85 after higher rate tax relief).

Giant Advantage

Honoured by the Benefits Excellence Awards, Giant Advantage is an extensive employee benefits program that can save you £1000’s each year.